AMERICAN WATER REPORTS THIRD QUARTER 2022 RESULTS; AFFIRMS 2022 GUIDANCE; ANNOUNCES 2023 EPS GUIDANCE, LONG-TERM TARGETS, AND CAPITAL INVESTMENT PLANS

- Third quarter 2022 earnings of $1.63 per share, compared to $1.53 per share in 2021; Year-to-date 2022 earnings of $3.70 per share, compared to $3.40 per share in 2021

- Quarter and year-to-date results as compared to the prior year reflect an estimated favorable impact due to weather of $0.07 per share and $0.04 per share, respectively

- Invested $1.9 billion year-to-date and added 79,300 customer connections year-to-date through closed acquisitions and organic growth; total capital plan on track to invest approximately $2.5 billion in 2022

- The Company’s Pennsylvania subsidiary entered into an agreement to acquire the wastewater system of the Butler Area Sewer Authority, for $231.5 million, which will add approximately 14,700 equivalent customer connections

- 2022 earnings guidance range of $4.39 to $4.49 per share affirmed, on a weather normalized basis; Year-to-date results include an estimated $0.06 of favorable weather, as compared to normal

- Initiating 2023 earnings guidance range of $4.72 to $4.82 per share and affirming long-term EPS growth of 7-9%

CAMDEN, N.J., October 31, 2022 - American Water Works Company, Inc. (NYSE: AWK) today reported results for the quarter ended September 30, 2022, of $1.63 per share, compared to $1.53 per share in 2021. The Company today also announced 2023 earnings per share guidance and long-term targets.

“We made great progress in executing our regulatory and acquisition strategies these last few months,” said Susan Hardwick, president and CEO of American Water. “Achieving settlements in the rate cases in our two largest jurisdictions, New Jersey and Pennsylvania, is a constructive step forward for our customers and our operations in each state."

“We also announced a few weeks ago an agreement to acquire assets serving another nearly 15,000 wastewater customers in western Pennsylvania. We look forward to completing that transaction in 2023. We remain firmly on track for a strong finish to 2022 and look forward to continuing to deliver on our strategies in 2023,” said Hardwick.

2022 Earnings Guidance Affirmed

The Company affirms its 2022 earnings per share guidance range of $4.39 to $4.49 on a weather normalized basis. The Company’s earnings forecasts and targets are subject to numerous risks and uncertainties, including, without limitation, those described under “Cautionary Statement Concerning Forward-Looking Statements” below and under “Risk Factors” in its annual, quarterly, and current reports filed with the Securities and Exchange Commission (“SEC”). All statements related to earnings and earnings per share refer to diluted earnings and earnings per share.

Targets Established

Financial

- 2023 earnings guidance range of $4.72 to $4.82 per share

- Long-term EPS compound annual growth rate (“CAGR”) of 7-9% unchanged

- Long-term dividend growth expectation of 7-9%, narrowed to align with long-term EPS CAGR

- 2023-2027 capital investment plan increased to $14-$15 billion and $30-$34 billion for the 10-year period of 2023-2032

Environmental

- By 2035, reduce absolute scope 1 and scope 2 emissions by 50% (2020 baseline)

- Achieve net zero scope 1 and scope 2 emissions by 2050

- First time disclosure of scope 3 emissions estimated at 506,000 metric tons in 2021

Consolidated Results

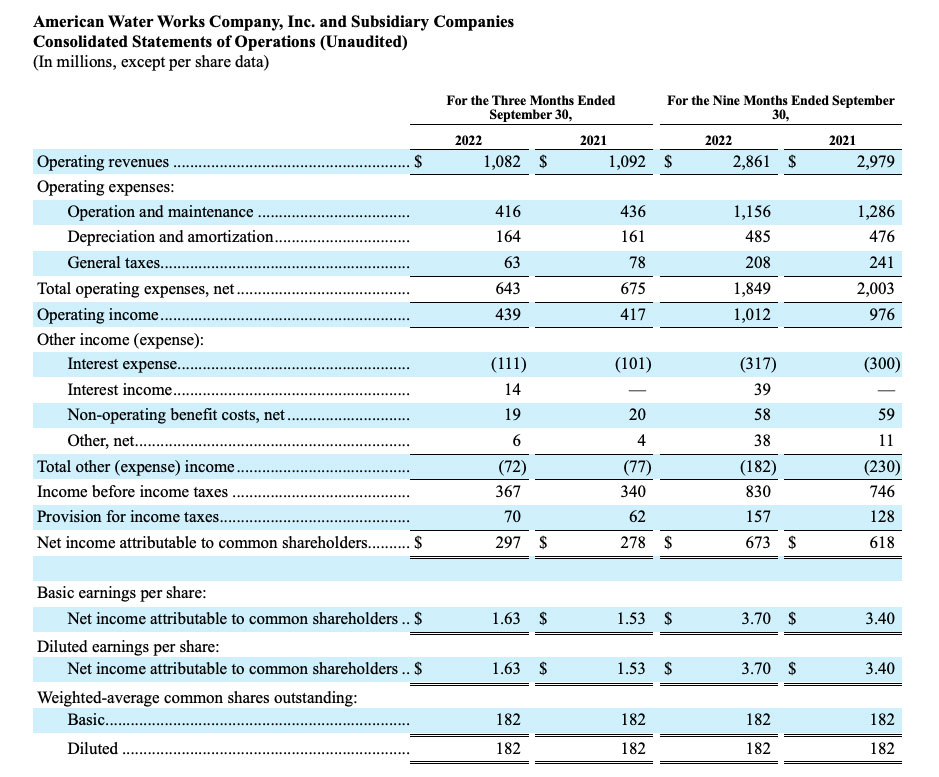

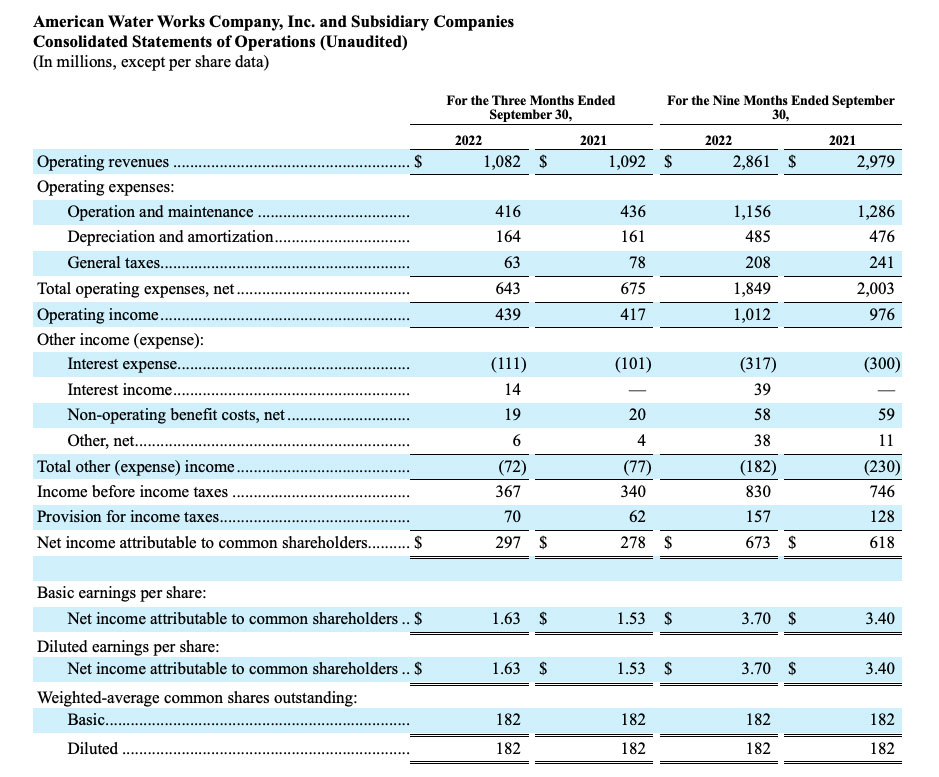

For the three and nine months ended September 30, 2022, earnings per share were $1.63 and $3.70, respectively, compared to $1.53 and $3.40 per share in the same periods in 2021. These increases were primarily driven by the implementation of new rates in the Regulated Businesses for the recovery of capital and acquisition investments, offset somewhat by impacts from inflationary pressures on production costs and higher interest costs. Results for the three and nine months ended September 30, 2022, also reflect the favorable impact of weather, estimated at $0.06 per share, primarily due to hot and dry weather in the third quarter of 2022 as compared to a $0.01 per share unfavorable impact and $0.02 per share favorable impact for the three and nine months ended September 30, 2021, respectively. Also, included in the results for the three and nine months ended September 30, 2022, are $0.06 and $0.18 per share, respectively, from interest income earned on the seller note and income earned on revenue share agreements, which compares to Homeowner Services Group (“HOS”) operating results for the three and nine months ended September 30, 2021, of $0.09 and $0.25 per share, respectively. Results for 2021 included $0.09 and $0.10 per share for the three and nine months ended September 30, 2021, respectively, related to the operating results of the New York subsidiary (which was sold in January 2022).

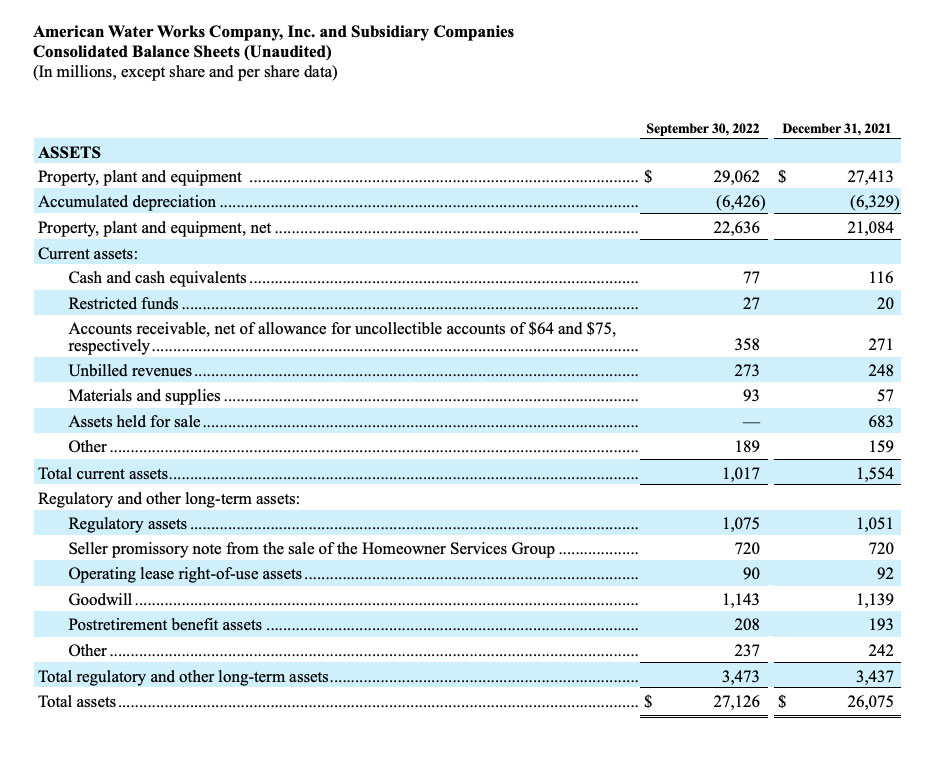

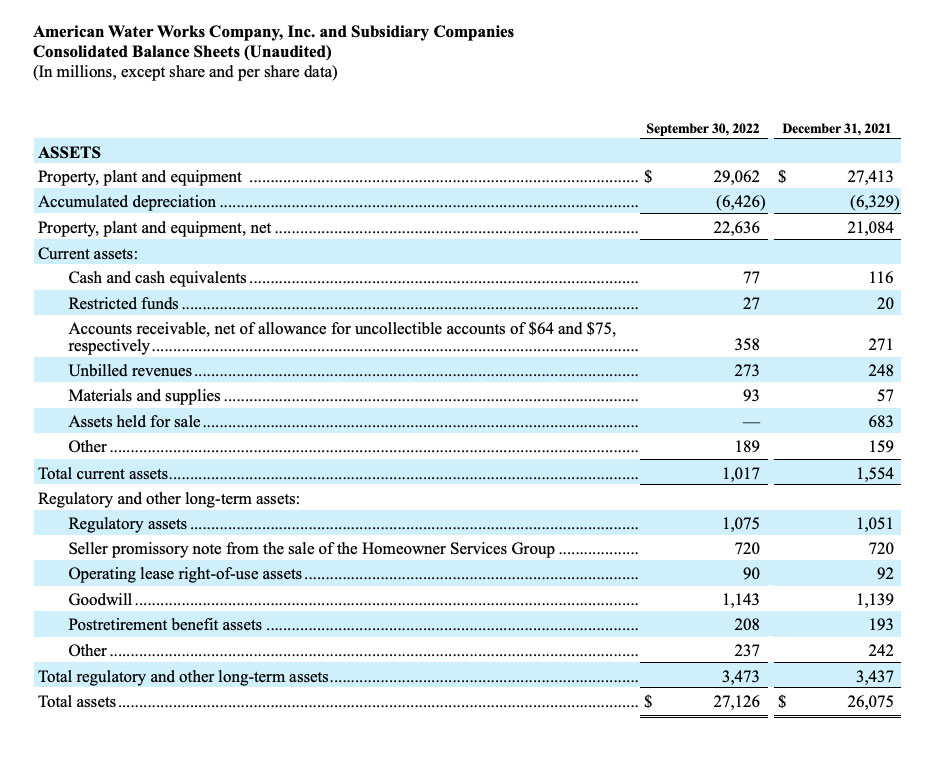

The Company is on track to meet its capital investment plan for the year with investments of $1.9 billion in the first nine months of 2022, including $1.6 billion for infrastructure improvements and replacements in the Regulated Businesses. The Company plans to invest a total of approximately $2.5 billion across its footprint in 2022.

Regulated Businesses

In the third quarter of 2022, Regulated Businesses’ net income was $302 million, compared to $273 million for the same period in 2021. For the first nine months of 2022, Regulated Businesses’ net income was $681 million, compared to $623 million for the same period in 2021. Net income attributable to the Company’s New York subsidiary was $16 million and $17 million for the three and nine months ended September 30, 2021, respectively.

Operating revenues increased $104 million and $187 million for the three and nine months ended September 30, 2022, respectively, as compared to 2021, when excluding revenues contributed by the Company’s New York subsidiary in 2021. The increases in operating revenues were primarily a result of authorized revenue increases resulting from completed general rate cases and infrastructure proceedings to recover incremental capital and acquisition investments.

To date, the Company has been authorized additional annualized revenues of approximately $111 million from general rate cases in 2022. Further, approximately $82 million of additional annualized revenues from infrastructure surcharges have been authorized and are effective in 2022. The Company has general rate cases in progress in five jurisdictions, two of which have settlements filed and are awaiting final approval, and has filed for infrastructure surcharges in two jurisdictions, reflecting a total annualized revenue request of approximately $479 million.

Excluding impacts of the Company’s New York subsidiary in 2021, operation and maintenance (“O&M”) expenses were higher by $29 million and $44 million for the three and nine months ended September 30, 2022, respectively, as compared to 2021, primarily due to increases in production costs from inflationary pressures. Also, depreciation expense was higher by $10 million and $24 million in these same periods due to the growing capital investment.

For the three and nine months ended September 30, 2021, results included revenues of $45 million and $97 million, respectively, and operating expenses of $22 million and $71 million, respectively, for the Company’s New York subsidiary that was sold on January 1, 2022.

Market-Based Businesses and Other

In the third quarter of 2022, the net loss in Market-Based Businesses and Other was $5 million, compared to net income of $5 million for the same period in 2021. For the first nine months of 2022, the net loss in Market-Based Businesses and Other was $8 million, compared to net loss of $5 million for the same period in 2021. The primary driver for the change in both periods is the loss of earnings from HOS operations as a result of the sale of the business in 2021 and incremental interest expense on long-term debt in 2022. The loss of HOS operating results has been partially offset in both periods of 2022 with interest income earned on the seller note from the sale and continuing income earned on revenue share agreements. Year-to-date results in 2022 also reflect a net benefit of $0.06 per share from post-close adjustments from the sale of HOS and the Company’s New York subsidiary.

Dividends

On October 27, 2022, the Company’s Board of Directors declared a quarterly cash dividend payment of $0.6550 per share of common stock, payable on December 1, 2022, to shareholders of record as of November 8, 2022.

2022 Third Quarter Earnings & 2023 Earnings and Long-Term Guidance Conference Call

The conference call to discuss third quarter 2022 earnings, 2023 earnings guidance, and long-term targets will take place on Tuesday, November 1, 2022, at 9 a.m. Eastern Daylight Time. Interested parties may listen to an audio webcast through a link on the Company’s Investor Relations website at ir.amwater.com. Presentation slides that will be used in conjunction with the earnings conference call will also be made available online in advance at ir.amwater.com. The Company recognizes its website as a key channel of distribution to reach public investors and as a means of disclosing material non-public information to comply with its obligations under SEC Regulation FD.

Following the earnings conference call, a replay of the audio webcast will be available for one year on American Water’s investor relations website at ir.amwater.com/events.

About American Water

With a history dating back to 1886, American Water is the largest and most geographically diverse U.S. publicly traded water and wastewater utility company. The Company employs approximately 6,400 dedicated professionals who provide regulated and market-based drinking water, wastewater and other related services to over 14 million people in 24 states. More information can be found by visiting amwater.com and follow American Water on Twitter, Facebook and LinkedIn.

Throughout this press release, unless the context otherwise requires, references to the “Company” and “American Water” mean American Water Works Company, Inc. and all of its subsidiaries, taken together as a whole.

Cautionary Statement Concerning Forward-Looking Statements

Certain statements in this press release including, without limitation, 2022 and 2023 earnings guidance, the Company’s long-term financial, growth and dividend targets, future capital needs, the ability to achieve the Company’s strategies and goals, including with respect to its ESG focus and related to the Company’s receipt of contingent consideration from the sale of HOS, the repayment of the seller note and the redeployment of the net proceeds from its divestitures, the outcome of the Company’s pending acquisition activity, the amount and allocation of projected capital expenditures, and estimated revenues from rate cases and other government agency authorizations, are forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and the Federal securities laws. In some cases, these forward-looking statements can be identified by words with prospective meanings such as “intend,” “plan,” “estimate,” “believe,” “anticipate,” “expect,” “predict,” “project,” “propose,” “assume,” “forecast,” “outlook,” “likely,” “uncertain,” “future,” “pending,” “goal,” “objective,” “potential,” “continue,” “seek to,” “may,” “can,” “will,” “should” and “could” and or the negative of such terms or other variations or similar expressions. These forward-looking statements are predictions based on American Water’s current expectations and assumptions regarding future events. They are not guarantees or assurances of any outcomes, financial results, levels of activity, performance or achievements, and readers are cautioned not to place undue reliance upon them. The forward-looking statements are subject to a number of estimates and assumptions, and known and unknown risks, uncertainties and other factors. Actual results may differ materially from those discussed in the forward-looking statements included in this press release as a result of the factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021, and subsequent filings with the SEC, and because of factors such as: the decisions of governmental and regulatory bodies, including decisions to raise or lower customer rates and regulatory responses to the COVID-19 pandemic; the timeliness and outcome of regulatory commissions’ and other authorities’ actions concerning rates, capital structure, authorized return on equity, capital investment, system acquisitions and dispositions, taxes, permitting, water supply and management, and other decisions; changes in customer demand for, and patterns of use of, water, such as may result from conservation efforts, impacts of the COVID-19 pandemic, or otherwise; a loss of one or more large industrial or commercial customers due to adverse economic conditions, the COVID-19 pandemic, or other factors; limitations on the availability of the Company’s water supplies or sources of water, or restrictions on its use thereof, resulting from allocation rights, governmental or regulatory requirements and restrictions, drought, overuse or other factors; changes in laws, governmental regulations and policies, including with respect to the environment, health and safety, water quality and water quality accountability, contaminants of emerging concern, public utility and tax regulations and policies, and impacts resulting from U.S., state and local elections and changes in federal, state and local executive administrations; the Company’s ability to collect, distribute, use, secure and store consumer data in compliance with current or future governmental laws, regulation and policies with respect to data and consumer privacy, security and protection; weather conditions and events, climate variability patterns, and natural disasters, including drought or abnormally high rainfall, prolonged and abnormal ice or freezing conditions, strong winds, coastal and intercoastal flooding, pandemics (including COVID-19) and epidemics, earthquakes, landslides, hurricanes, tornadoes, wildfires, electrical storms, sinkholes and solar flares; the outcome of litigation and similar governmental and regulatory proceedings, investigations or actions; the risks associated with the Company’s aging infrastructure, and its ability to appropriately improve the resiliency of, or maintain and replace, current or future infrastructure and systems, including its technology and other assets, and manage the expansion of its businesses; exposure or infiltration of the Company’s technology and critical infrastructure systems, including the disclosure of sensitive, personal or confidential information contained therein, through physical or cyber attacks or other means; the Company’s ability to obtain permits and other approvals for projects and construction of various water and wastewater facilities; changes in the Company’s capital requirements; the Company’s ability to control operating expenses and to achieve operating efficiencies; the intentional or unintentional actions of a third party, including contamination of the Company’s water supplies or the water provided to its customers; the Company’s ability to obtain adequate and cost-effective supplies of pipe, equipment (including personal protective equipment), chemicals, electricity, fuel, water and other raw materials and to address or mitigate supply chain constraints impacting the Company’s business operations; the Company’s ability to successfully meet its operational growth projections, either individually or in the aggregate, and capitalize on growth opportunities, including, among other things, with respect to acquiring, closing and successfully integrating regulated operations and market-based businesses, the Company’s Military Services Group entering into new contracts, price redeterminations and other agreements and contracts, and realizing anticipated benefits and synergies from new acquisitions; risks and uncertainties following the completion of the sale of HOS and the Company’s New York subsidiary; risks and uncertainties associated with contracting with the U.S. government, including ongoing compliance with applicable government procurement and security regulations; cost overruns relating to improvements in or the expansion of the Company’s operations; the Company’s ability to successfully develop and implement new technologies and to protect related intellectual property; the Company’s ability to maintain safe work sites; the Company’s exposure to liabilities related to environmental laws and similar matters resulting from, among other things, water and wastewater service provided to customers; changes in general economic, political, business and financial market conditions, including without limitation conditions and collateral consequences associated with COVID-19; access to sufficient debt and/or equity capital on satisfactory terms and when and as needed to support operations and capital expenditures; fluctuations in inflation or interest rates and the Company’s ability to address or mitigate the impacts thereof; the ability to comply with affirmative or negative covenants in the current or future indebtedness of the Company or any of its subsidiaries, or the issuance of new or modified credit ratings or outlooks or other communications by credit rating agencies with respect to the Company or any of its subsidiaries (or any current or future indebtedness thereof), which could increase financing costs or funding requirements and affect the Company’s or its subsidiaries’ ability to issue, repay or redeem debt, pay dividends or make distributions; fluctuations in the value of benefit plan assets and liabilities that could increase the Company’s cost and funding requirements; changes in federal or state general, income and other tax laws, including (i) future significant tax legislation; (ii) the availability of, or the Company’s compliance with, the terms of applicable tax credits and tax abatement programs; and (iii) the Company’s ability to utilize its state income tax net operating loss carryforwards; migration of customers into or out of the Company’s service territories; the use by municipalities of the power of eminent domain or other authority to condemn the systems of one or more of the Company’s utility subsidiaries, or the assertion by private landowners of similar rights against such utility subsidiaries; any difficulty or inability to obtain insurance for the Company, its inability to obtain insurance at acceptable rates and on acceptable terms and conditions, or its inability to obtain reimbursement under existing or future insurance programs and coverages for any losses sustained; the incurrence of impairment charges related to the Company’s goodwill or other assets; labor actions, including work stoppages and strikes; the Company’s ability to retain and attract qualified employees; civil disturbances or unrest, or terrorist threats or acts, or public apprehension about future disturbances, unrest, or terrorist threats or acts; and the impact of new, and changes to existing, accounting standards.

These forward-looking statements are qualified by, and should be read together with, the risks and uncertainties set forth above and the risk factors included in American Water’s annual, quarterly and other SEC filings, and readers should refer to such risks, uncertainties and risk factors in evaluating such forward-looking statements. Any forward-looking statements American Water makes speak only as of the date of this press release. American Water does not have or undertake any obligation or intention to update or revise any forward-looking statement, whether as a result of new information, future events, changed circumstances or otherwise, except as otherwise required by the federal securities laws. New factors emerge from time to time, and it is not possible for the Company to predict all such factors. Furthermore, it may not be possible to assess the impact of any such factor on the Company’s businesses, either viewed independently or together, or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. The foregoing factors should not be construed as exhaustive.

AWK-IR

About American Water

With a history dating back to 1886, American Water (NYSE:AWK) is the largest and most geographically diverse U.S. publicly traded water and wastewater utility company. The company employs more than 6,400 dedicated professionals who provide regulated and regulated-like drinking water and wastewater services to more than 14 million people in 24 states. American Water provides safe, clean, affordable and reliable water services to our customers to help keep their lives flowing. For more information, visit amwater.com and diversityataw.com.Follow American Water on Twitter, Facebook, and LinkedIn.

Media Contacts

Maureen Duffy

Senior Vice President, Communications and External Affairs

856-955-4163

maureen.duffy@amwater.com

- Third quarter 2022 earnings of $1.63 per share, compared to $1.53 per share in 2021; Year-to-date 2022 earnings of $3.70 per share, compared to $3.40 per share in 2021

- Quarter and year-to-date results as compared to the prior year reflect an estimated favorable impact due to weather of $0.07 per share and $0.04 per share, respectively

- Invested $1.9 billion year-to-date and added 79,300 customer connections year-to-date through closed acquisitions and organic growth; total capital plan on track to invest approximately $2.5 billion in 2022

- The Company’s Pennsylvania subsidiary entered into an agreement to acquire the wastewater system of the Butler Area Sewer Authority, for $231.5 million, which will add approximately 14,700 equivalent customer connections

- 2022 earnings guidance range of $4.39 to $4.49 per share affirmed, on a weather normalized basis; Year-to-date results include an estimated $0.06 of favorable weather, as compared to normal

- Initiating 2023 earnings guidance range of $4.72 to $4.82 per share and affirming long-term EPS growth of 7-9%

CAMDEN, N.J., October 31, 2022 - American Water Works Company, Inc. (NYSE: AWK) today reported results for the quarter ended September 30, 2022, of $1.63 per share, compared to $1.53 per share in 2021. The Company today also announced 2023 earnings per share guidance and long-term targets.

“We made great progress in executing our regulatory and acquisition strategies these last few months,” said Susan Hardwick, president and CEO of American Water. “Achieving settlements in the rate cases in our two largest jurisdictions, New Jersey and Pennsylvania, is a constructive step forward for our customers and our operations in each state."

“We also announced a few weeks ago an agreement to acquire assets serving another nearly 15,000 wastewater customers in western Pennsylvania. We look forward to completing that transaction in 2023. We remain firmly on track for a strong finish to 2022 and look forward to continuing to deliver on our strategies in 2023,” said Hardwick.

2022 Earnings Guidance Affirmed

The Company affirms its 2022 earnings per share guidance range of $4.39 to $4.49 on a weather normalized basis. The Company’s earnings forecasts and targets are subject to numerous risks and uncertainties, including, without limitation, those described under “Cautionary Statement Concerning Forward-Looking Statements” below and under “Risk Factors” in its annual, quarterly, and current reports filed with the Securities and Exchange Commission (“SEC”). All statements related to earnings and earnings per share refer to diluted earnings and earnings per share.

Targets Established

Financial

- 2023 earnings guidance range of $4.72 to $4.82 per share

- Long-term EPS compound annual growth rate (“CAGR”) of 7-9% unchanged

- Long-term dividend growth expectation of 7-9%, narrowed to align with long-term EPS CAGR

- 2023-2027 capital investment plan increased to $14-$15 billion and $30-$34 billion for the 10-year period of 2023-2032

Environmental

- By 2035, reduce absolute scope 1 and scope 2 emissions by 50% (2020 baseline)

- Achieve net zero scope 1 and scope 2 emissions by 2050

- First time disclosure of scope 3 emissions estimated at 506,000 metric tons in 2021

Consolidated Results

For the three and nine months ended September 30, 2022, earnings per share were $1.63 and $3.70, respectively, compared to $1.53 and $3.40 per share in the same periods in 2021. These increases were primarily driven by the implementation of new rates in the Regulated Businesses for the recovery of capital and acquisition investments, offset somewhat by impacts from inflationary pressures on production costs and higher interest costs. Results for the three and nine months ended September 30, 2022, also reflect the favorable impact of weather, estimated at $0.06 per share, primarily due to hot and dry weather in the third quarter of 2022 as compared to a $0.01 per share unfavorable impact and $0.02 per share favorable impact for the three and nine months ended September 30, 2021, respectively. Also, included in the results for the three and nine months ended September 30, 2022, are $0.06 and $0.18 per share, respectively, from interest income earned on the seller note and income earned on revenue share agreements, which compares to Homeowner Services Group (“HOS”) operating results for the three and nine months ended September 30, 2021, of $0.09 and $0.25 per share, respectively. Results for 2021 included $0.09 and $0.10 per share for the three and nine months ended September 30, 2021, respectively, related to the operating results of the New York subsidiary (which was sold in January 2022).

The Company is on track to meet its capital investment plan for the year with investments of $1.9 billion in the first nine months of 2022, including $1.6 billion for infrastructure improvements and replacements in the Regulated Businesses. The Company plans to invest a total of approximately $2.5 billion across its footprint in 2022.

Regulated Businesses

In the third quarter of 2022, Regulated Businesses’ net income was $302 million, compared to $273 million for the same period in 2021. For the first nine months of 2022, Regulated Businesses’ net income was $681 million, compared to $623 million for the same period in 2021. Net income attributable to the Company’s New York subsidiary was $16 million and $17 million for the three and nine months ended September 30, 2021, respectively.

Operating revenues increased $104 million and $187 million for the three and nine months ended September 30, 2022, respectively, as compared to 2021, when excluding revenues contributed by the Company’s New York subsidiary in 2021. The increases in operating revenues were primarily a result of authorized revenue increases resulting from completed general rate cases and infrastructure proceedings to recover incremental capital and acquisition investments.

To date, the Company has been authorized additional annualized revenues of approximately $111 million from general rate cases in 2022. Further, approximately $82 million of additional annualized revenues from infrastructure surcharges have been authorized and are effective in 2022. The Company has general rate cases in progress in five jurisdictions, two of which have settlements filed and are awaiting final approval, and has filed for infrastructure surcharges in two jurisdictions, reflecting a total annualized revenue request of approximately $479 million.

Excluding impacts of the Company’s New York subsidiary in 2021, operation and maintenance (“O&M”) expenses were higher by $29 million and $44 million for the three and nine months ended September 30, 2022, respectively, as compared to 2021, primarily due to increases in production costs from inflationary pressures. Also, depreciation expense was higher by $10 million and $24 million in these same periods due to the growing capital investment.

For the three and nine months ended September 30, 2021, results included revenues of $45 million and $97 million, respectively, and operating expenses of $22 million and $71 million, respectively, for the Company’s New York subsidiary that was sold on January 1, 2022.

Market-Based Businesses and Other

In the third quarter of 2022, the net loss in Market-Based Businesses and Other was $5 million, compared to net income of $5 million for the same period in 2021. For the first nine months of 2022, the net loss in Market-Based Businesses and Other was $8 million, compared to net loss of $5 million for the same period in 2021. The primary driver for the change in both periods is the loss of earnings from HOS operations as a result of the sale of the business in 2021 and incremental interest expense on long-term debt in 2022. The loss of HOS operating results has been partially offset in both periods of 2022 with interest income earned on the seller note from the sale and continuing income earned on revenue share agreements. Year-to-date results in 2022 also reflect a net benefit of $0.06 per share from post-close adjustments from the sale of HOS and the Company’s New York subsidiary.

Dividends

On October 27, 2022, the Company’s Board of Directors declared a quarterly cash dividend payment of $0.6550 per share of common stock, payable on December 1, 2022, to shareholders of record as of November 8, 2022.

2022 Third Quarter Earnings & 2023 Earnings and Long-Term Guidance Conference Call

The conference call to discuss third quarter 2022 earnings, 2023 earnings guidance, and long-term targets will take place on Tuesday, November 1, 2022, at 9 a.m. Eastern Daylight Time. Interested parties may listen to an audio webcast through a link on the Company’s Investor Relations website at ir.amwater.com. Presentation slides that will be used in conjunction with the earnings conference call will also be made available online in advance at ir.amwater.com. The Company recognizes its website as a key channel of distribution to reach public investors and as a means of disclosing material non-public information to comply with its obligations under SEC Regulation FD.

Following the earnings conference call, a replay of the audio webcast will be available for one year on American Water’s investor relations website at ir.amwater.com/events.

About American Water

With a history dating back to 1886, American Water is the largest and most geographically diverse U.S. publicly traded water and wastewater utility company. The Company employs approximately 6,400 dedicated professionals who provide regulated and market-based drinking water, wastewater and other related services to over 14 million people in 24 states. More information can be found by visiting amwater.com and follow American Water on Twitter, Facebook and LinkedIn.

Throughout this press release, unless the context otherwise requires, references to the “Company” and “American Water” mean American Water Works Company, Inc. and all of its subsidiaries, taken together as a whole.

Cautionary Statement Concerning Forward-Looking Statements

Certain statements in this press release including, without limitation, 2022 and 2023 earnings guidance, the Company’s long-term financial, growth and dividend targets, future capital needs, the ability to achieve the Company’s strategies and goals, including with respect to its ESG focus and related to the Company’s receipt of contingent consideration from the sale of HOS, the repayment of the seller note and the redeployment of the net proceeds from its divestitures, the outcome of the Company’s pending acquisition activity, the amount and allocation of projected capital expenditures, and estimated revenues from rate cases and other government agency authorizations, are forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and the Federal securities laws. In some cases, these forward-looking statements can be identified by words with prospective meanings such as “intend,” “plan,” “estimate,” “believe,” “anticipate,” “expect,” “predict,” “project,” “propose,” “assume,” “forecast,” “outlook,” “likely,” “uncertain,” “future,” “pending,” “goal,” “objective,” “potential,” “continue,” “seek to,” “may,” “can,” “will,” “should” and “could” and or the negative of such terms or other variations or similar expressions. These forward-looking statements are predictions based on American Water’s current expectations and assumptions regarding future events. They are not guarantees or assurances of any outcomes, financial results, levels of activity, performance or achievements, and readers are cautioned not to place undue reliance upon them. The forward-looking statements are subject to a number of estimates and assumptions, and known and unknown risks, uncertainties and other factors. Actual results may differ materially from those discussed in the forward-looking statements included in this press release as a result of the factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021, and subsequent filings with the SEC, and because of factors such as: the decisions of governmental and regulatory bodies, including decisions to raise or lower customer rates and regulatory responses to the COVID-19 pandemic; the timeliness and outcome of regulatory commissions’ and other authorities’ actions concerning rates, capital structure, authorized return on equity, capital investment, system acquisitions and dispositions, taxes, permitting, water supply and management, and other decisions; changes in customer demand for, and patterns of use of, water, such as may result from conservation efforts, impacts of the COVID-19 pandemic, or otherwise; a loss of one or more large industrial or commercial customers due to adverse economic conditions, the COVID-19 pandemic, or other factors; limitations on the availability of the Company’s water supplies or sources of water, or restrictions on its use thereof, resulting from allocation rights, governmental or regulatory requirements and restrictions, drought, overuse or other factors; changes in laws, governmental regulations and policies, including with respect to the environment, health and safety, water quality and water quality accountability, contaminants of emerging concern, public utility and tax regulations and policies, and impacts resulting from U.S., state and local elections and changes in federal, state and local executive administrations; the Company’s ability to collect, distribute, use, secure and store consumer data in compliance with current or future governmental laws, regulation and policies with respect to data and consumer privacy, security and protection; weather conditions and events, climate variability patterns, and natural disasters, including drought or abnormally high rainfall, prolonged and abnormal ice or freezing conditions, strong winds, coastal and intercoastal flooding, pandemics (including COVID-19) and epidemics, earthquakes, landslides, hurricanes, tornadoes, wildfires, electrical storms, sinkholes and solar flares; the outcome of litigation and similar governmental and regulatory proceedings, investigations or actions; the risks associated with the Company’s aging infrastructure, and its ability to appropriately improve the resiliency of, or maintain and replace, current or future infrastructure and systems, including its technology and other assets, and manage the expansion of its businesses; exposure or infiltration of the Company’s technology and critical infrastructure systems, including the disclosure of sensitive, personal or confidential information contained therein, through physical or cyber attacks or other means; the Company’s ability to obtain permits and other approvals for projects and construction of various water and wastewater facilities; changes in the Company’s capital requirements; the Company’s ability to control operating expenses and to achieve operating efficiencies; the intentional or unintentional actions of a third party, including contamination of the Company’s water supplies or the water provided to its customers; the Company’s ability to obtain adequate and cost-effective supplies of pipe, equipment (including personal protective equipment), chemicals, electricity, fuel, water and other raw materials and to address or mitigate supply chain constraints impacting the Company’s business operations; the Company’s ability to successfully meet its operational growth projections, either individually or in the aggregate, and capitalize on growth opportunities, including, among other things, with respect to acquiring, closing and successfully integrating regulated operations and market-based businesses, the Company’s Military Services Group entering into new contracts, price redeterminations and other agreements and contracts, and realizing anticipated benefits and synergies from new acquisitions; risks and uncertainties following the completion of the sale of HOS and the Company’s New York subsidiary; risks and uncertainties associated with contracting with the U.S. government, including ongoing compliance with applicable government procurement and security regulations; cost overruns relating to improvements in or the expansion of the Company’s operations; the Company’s ability to successfully develop and implement new technologies and to protect related intellectual property; the Company’s ability to maintain safe work sites; the Company’s exposure to liabilities related to environmental laws and similar matters resulting from, among other things, water and wastewater service provided to customers; changes in general economic, political, business and financial market conditions, including without limitation conditions and collateral consequences associated with COVID-19; access to sufficient debt and/or equity capital on satisfactory terms and when and as needed to support operations and capital expenditures; fluctuations in inflation or interest rates and the Company’s ability to address or mitigate the impacts thereof; the ability to comply with affirmative or negative covenants in the current or future indebtedness of the Company or any of its subsidiaries, or the issuance of new or modified credit ratings or outlooks or other communications by credit rating agencies with respect to the Company or any of its subsidiaries (or any current or future indebtedness thereof), which could increase financing costs or funding requirements and affect the Company’s or its subsidiaries’ ability to issue, repay or redeem debt, pay dividends or make distributions; fluctuations in the value of benefit plan assets and liabilities that could increase the Company’s cost and funding requirements; changes in federal or state general, income and other tax laws, including (i) future significant tax legislation; (ii) the availability of, or the Company’s compliance with, the terms of applicable tax credits and tax abatement programs; and (iii) the Company’s ability to utilize its state income tax net operating loss carryforwards; migration of customers into or out of the Company’s service territories; the use by municipalities of the power of eminent domain or other authority to condemn the systems of one or more of the Company’s utility subsidiaries, or the assertion by private landowners of similar rights against such utility subsidiaries; any difficulty or inability to obtain insurance for the Company, its inability to obtain insurance at acceptable rates and on acceptable terms and conditions, or its inability to obtain reimbursement under existing or future insurance programs and coverages for any losses sustained; the incurrence of impairment charges related to the Company’s goodwill or other assets; labor actions, including work stoppages and strikes; the Company’s ability to retain and attract qualified employees; civil disturbances or unrest, or terrorist threats or acts, or public apprehension about future disturbances, unrest, or terrorist threats or acts; and the impact of new, and changes to existing, accounting standards.

These forward-looking statements are qualified by, and should be read together with, the risks and uncertainties set forth above and the risk factors included in American Water’s annual, quarterly and other SEC filings, and readers should refer to such risks, uncertainties and risk factors in evaluating such forward-looking statements. Any forward-looking statements American Water makes speak only as of the date of this press release. American Water does not have or undertake any obligation or intention to update or revise any forward-looking statement, whether as a result of new information, future events, changed circumstances or otherwise, except as otherwise required by the federal securities laws. New factors emerge from time to time, and it is not possible for the Company to predict all such factors. Furthermore, it may not be possible to assess the impact of any such factor on the Company’s businesses, either viewed independently or together, or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. The foregoing factors should not be construed as exhaustive.

AWK-IR

About American Water

With a history dating back to 1886, American Water (NYSE:AWK) is the largest and most geographically diverse U.S. publicly traded water and wastewater utility company. The company employs more than 6,400 dedicated professionals who provide regulated and regulated-like drinking water and wastewater services to more than 14 million people in 24 states. American Water provides safe, clean, affordable and reliable water services to our customers to help keep their lives flowing. For more information, visit amwater.com and diversityataw.com.Follow American Water on Twitter, Facebook, and LinkedIn.

Media Contacts

Maureen Duffy

Senior Vice President, Communications and External Affairs

856-955-4163

maureen.duffy@amwater.com